“What’s going to happen when your pension is sucked up by these corporate cabals of bankers? What’s going to happen when your life savings is taken away?”

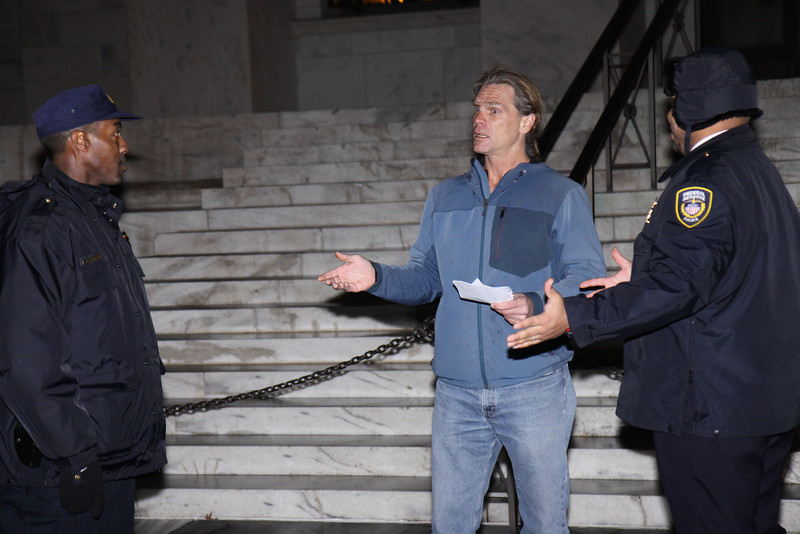

That’s what Barry Knight demanded to know as police hustled him off the steps of the headquarters of the Federal Reserve Bank, known as the Board of Governors for the Federal Reserve System.

The U.S. Federal Reserve, America’s central bank, turns 100 years old on December 23. Historically, there has been plenty of opposition to a central bank, but today, Knight believes the public is operating under a benign misperception.

“Most Americans when they think of Federal Reserve and the Board of Governors, terms like governors and federal, they believe that this is a government agency, when in fact it is not,” he said. “It is a private institution or a corporation, and by the very definition of a corporation, its sole purpose to is to maximize profit. And they don’t care about the socio-economic impacts.”

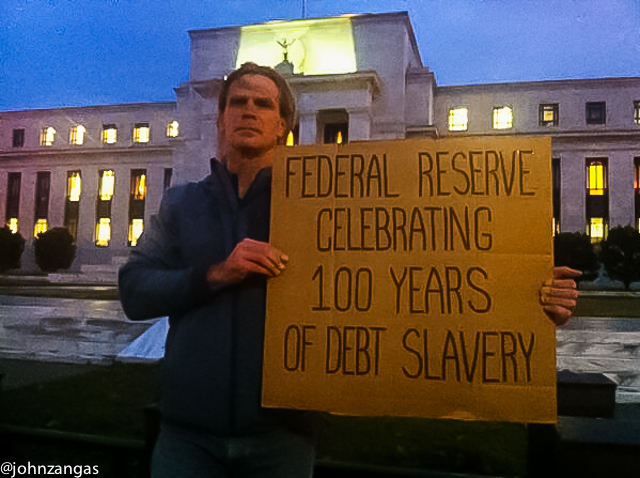

Among all the protests at the twelve branches of the Federal Reserve around the country, the protest at its very seat of power was probably the smallest. Only a handful of activists with signs and umbrellas stood in the drizzle on Constitution Ave.

FedUp100, a coalition of citizens demanding the nationalization of the U.S. Federal Reserve, planned to stage protests at branches including New York, San Francisco, Atlanta, Richmond, Chicago, Dallas, Philadelphia, Cleveland, Boston, Kansas City, St. Louis and Minneapolis.

Although it is a private entity, the Federal Reserve has sweeping powers to print money and alter interest rates without oversight by Congress. Barry Knight, holding a sign that said, “Federal Reserve Celebrating 100 Years of Debt Slavery,” tried to bring home how the Fed’s actions impact ordinary people.

“It dumps $85 billion into the economy, but the majority gets sucked up to the top. And meanwhile all that extra money they’ve added to the economy makes the dollars that we have worth even less.”

FedUp100’s solution is to nationalize the Federal Reserve from ownership by private member banks, which have benefited in trillions of dollars of interest-free loans, including the $700 billion TARP (Troubled Asset Relief Program) bailout of 2008.

“There’s no end to their corruption. They have ripped off so many people!” Knight said. “The repeal of the Glass-Steagal Act took away a lot of the regulations that were imposed on banks before and let them operate as casinos after that. Just like a casino, the house always wins.”

United Front Against Austerity (UFAA), an organization backing today’s protests against the Federal Reserve, suggests nationalization of the Federal Reserve could be accomplished by opening two “credit windows”: $4 trillion in zero-interest bonds to rebuild America’s infrastructure, and $1 trillion toward student loan refinancing, greatly expanding Senator Elizabeth Warren’s proposed plan. Such solutions might benefit people rather than the investment banks.

As of January, the Federal Reserve will cut back on buying government securities and less money will be released into the economy. But the enormous amount of debt already incurred by the Federal Reserve’s policies is going to be passed on to future generations.

“People should be concerned about themselves, but they’re not looking at the big picture,” Knight said. “They don’t realize that a year from now, two years from now, five years from now, the very same institutions that have caused so much deceit and corruption, fraud will steal their pensions, and they can be working their whole lives, only to find out when they retire, all that retirement is gone.”

- Photo by Ted Majdosz

- Photo by Ted Majdosz

- Photo by Ted Majdosz

- Photo by Ted Majdosz

Interview with Barry Knight. Police interrupt the interview to throw him off Federal Reserve property.